Amanda Cohen

54 years ago

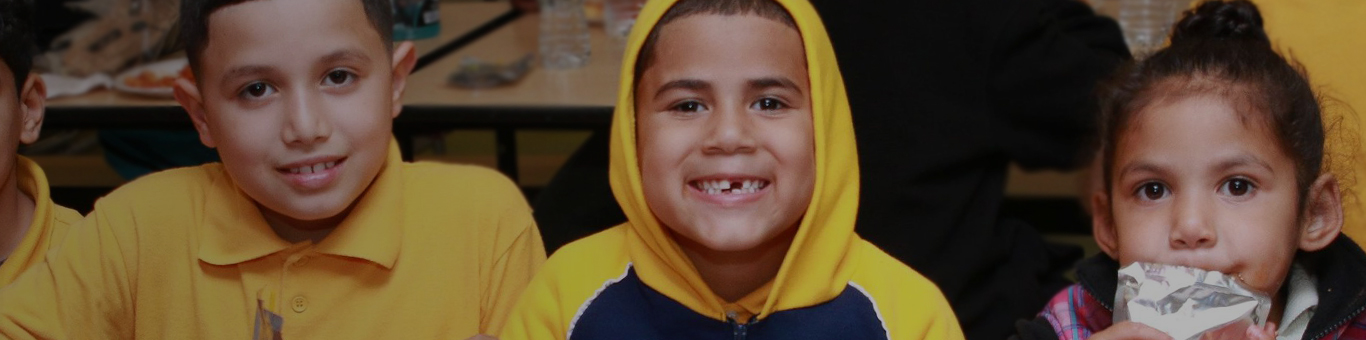

Onward860

-

April 2, 2024

- Posted by: Amanda Cohen

No Comments

Women of Tocqueville

-

April 3, 2022

- Posted by: Amanda Cohen

Eric Harrison is named President and CEO

-

April 2, 2022

- Posted by: Amanda Cohen

Building Foundations

-

April 2, 2021

- Posted by: Amanda Cohen

Dolly Parton’s Imagination Library

-

April 3, 2020

- Posted by: Amanda Cohen

Case Competition

-

April 4, 2017

- Posted by: Amanda Cohen

North Hartford Triple Aim Collaborative

-

April 4, 2017

- Posted by: Amanda Cohen

Working Cities Challenge

-

April 4, 2017

- Posted by: Amanda Cohen

Paula S. Gilberto is named President and CEO.

-

April 2, 2015

- Posted by: Amanda Cohen

ALICE Report

-

April 4, 2014

- Posted by: Amanda Cohen